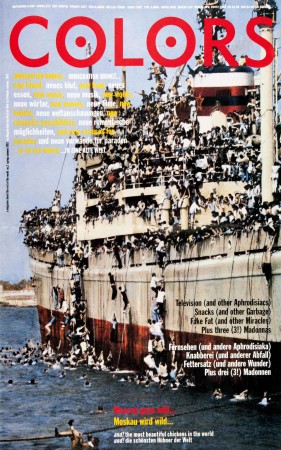

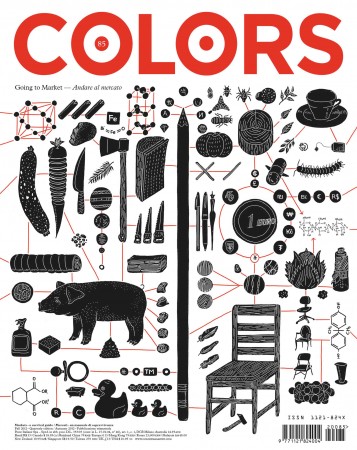

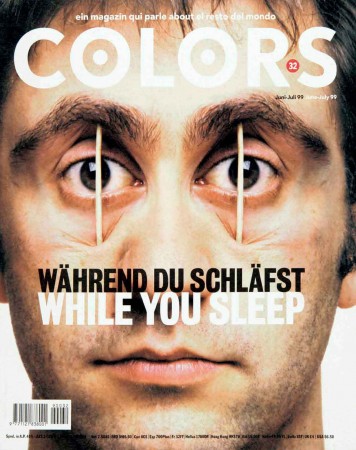

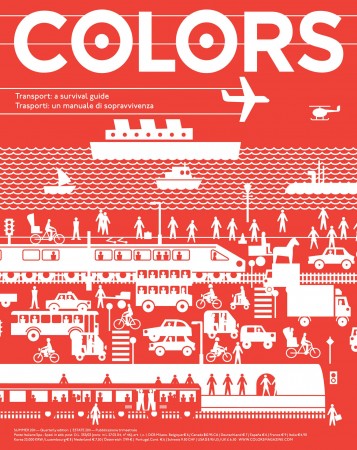

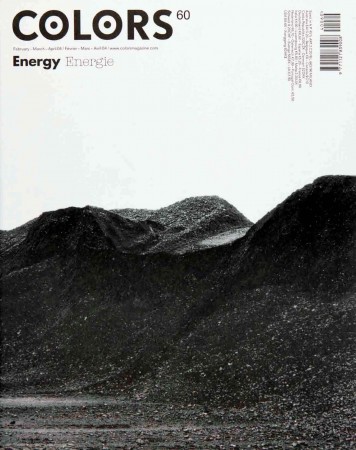

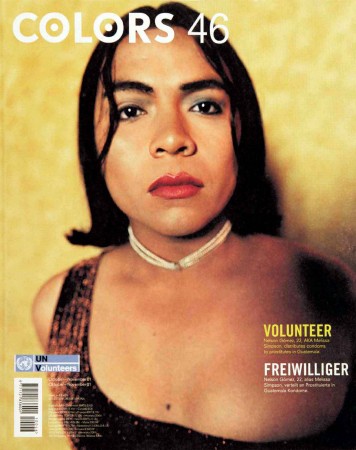

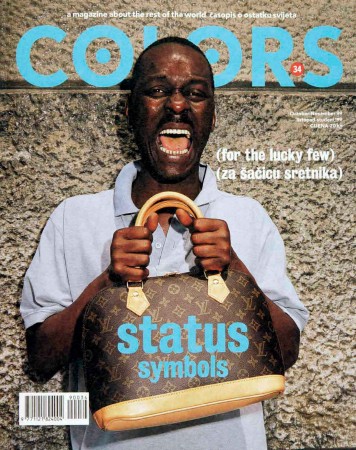

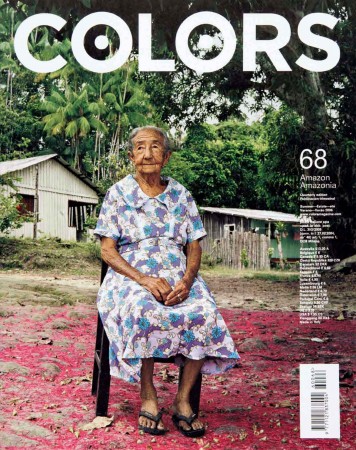

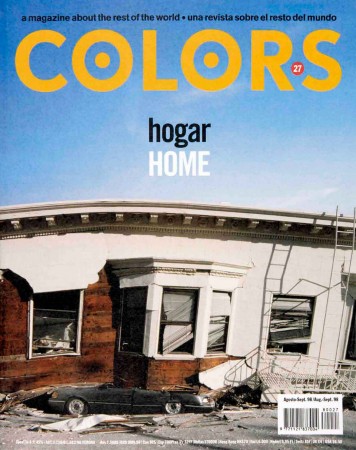

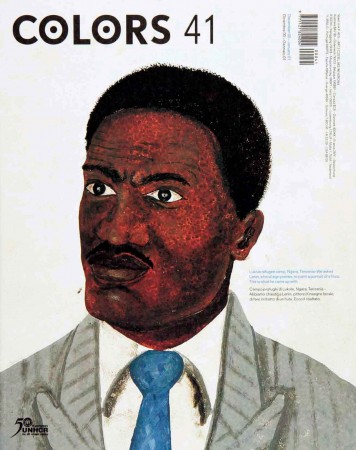

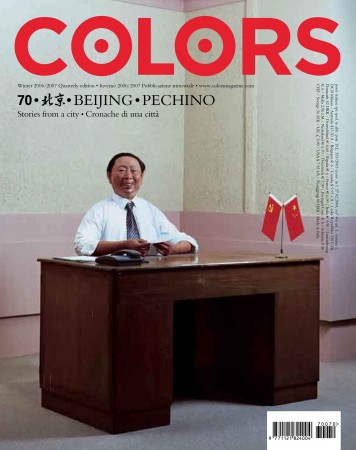

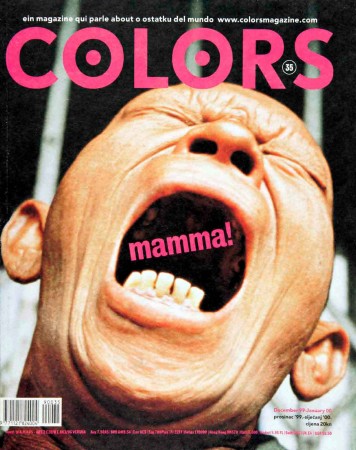

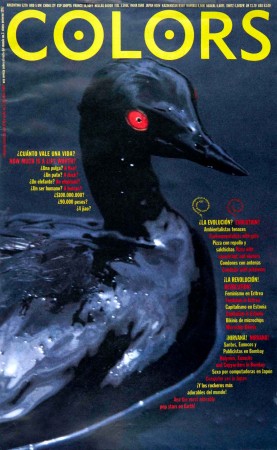

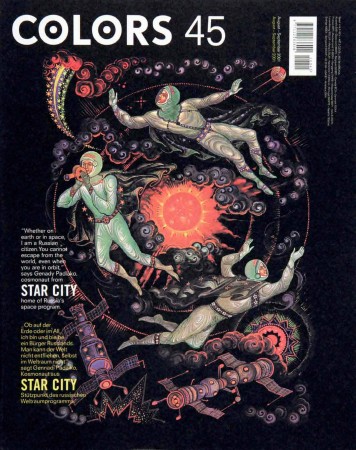

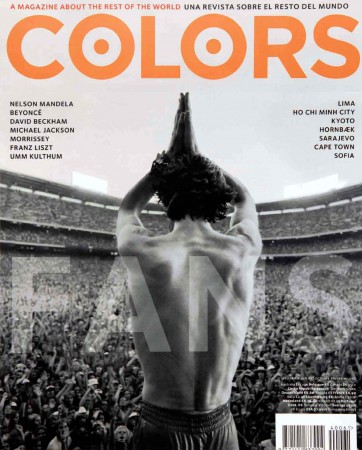

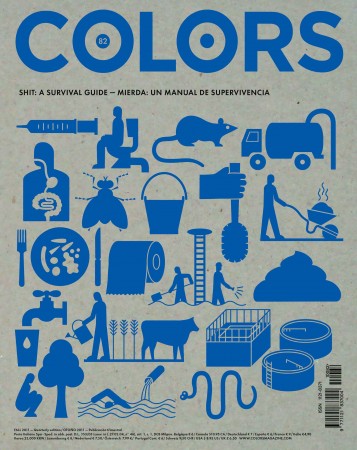

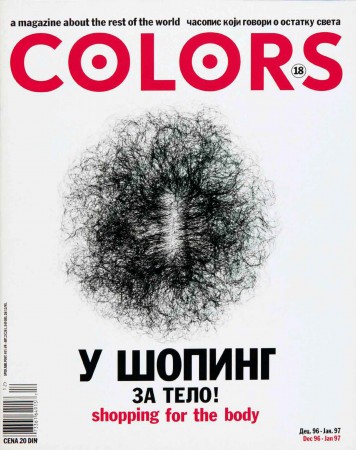

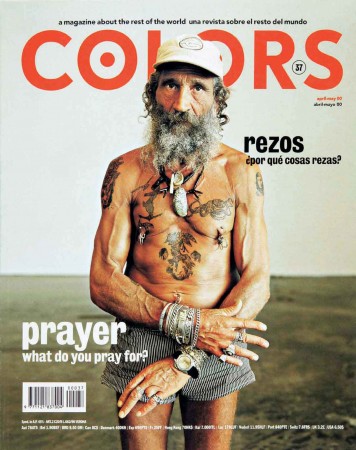

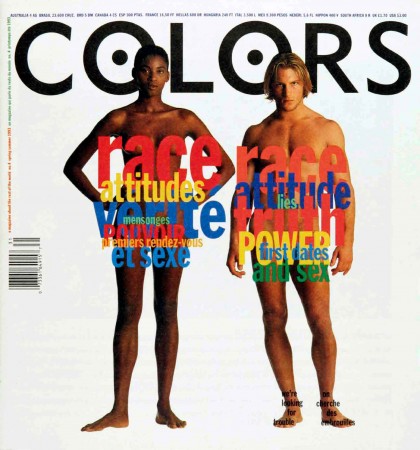

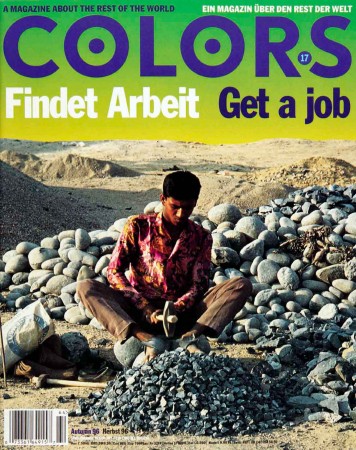

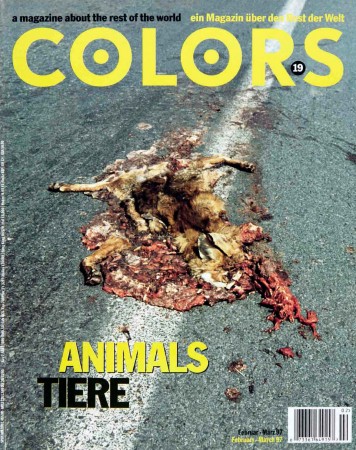

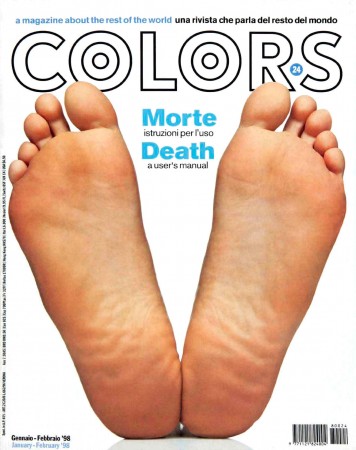

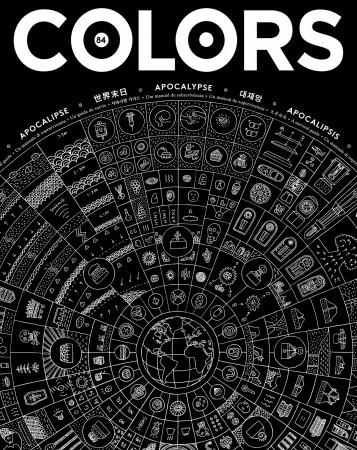

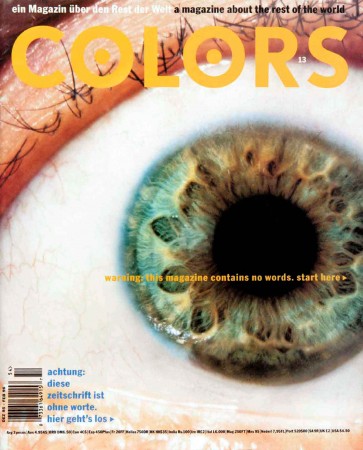

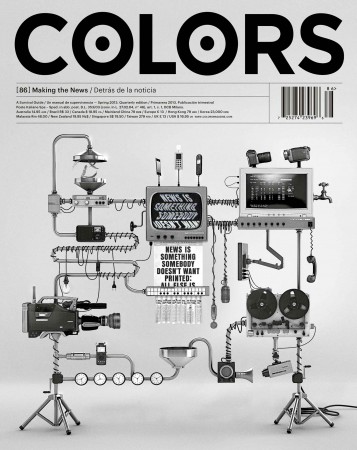

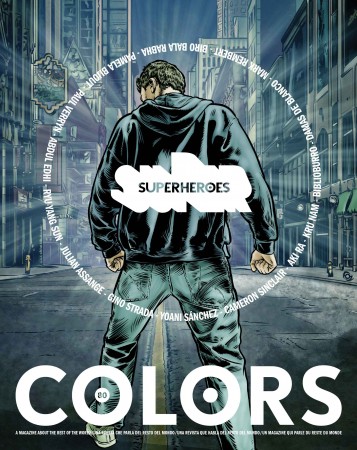

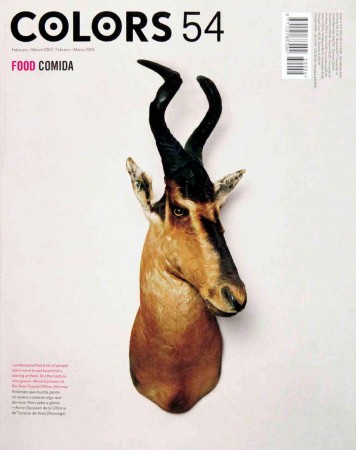

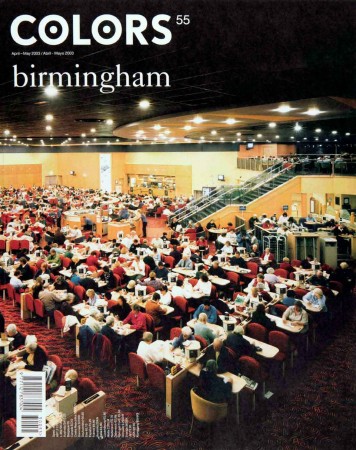

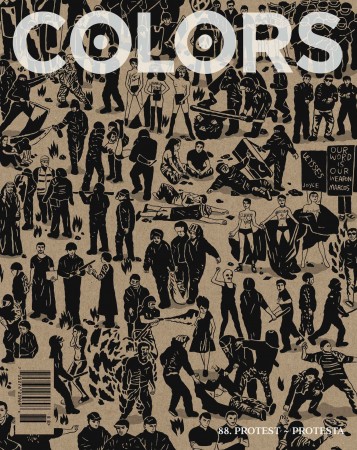

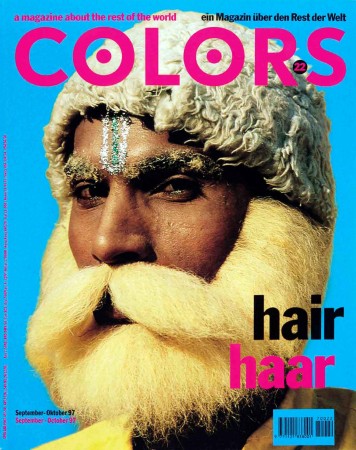

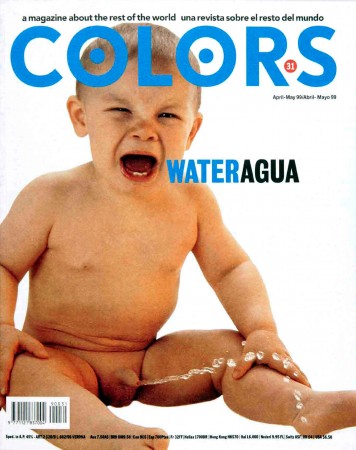

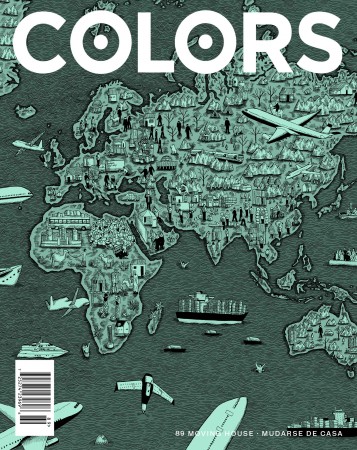

COLORS, A MAGAZINE ABOUT THE REST OF THE WORLD

COLORS è stato fondato nel 1991 da Oliviero Toscani e Tibor Kalman, convinti che le differenze siano positive e tutte le culture abbiano lo stesso valore. E' nato come magazine trimestrale, distribuito a livello internazionale in numerose edizioni bilingui ed è stato stampato fino al n° 90 Football (2014).

Il magazine ha ricevuto riconoscimenti dai media di tutto il mondo, come ad esempio Good Magazine che l’ha inserito nella classifica delle 51 migliori riviste di tutti i tempi, o il quotidiano spagnolo La Vanguardia che l’ha segnalata tra le riviste culturali più influenti nel panorama globale.

COLORS fa anche parte di Inside the great magazines, un documentario che analizza l’influenza che le riviste esercitano sulla nostra identità sociale, politica e culturale.

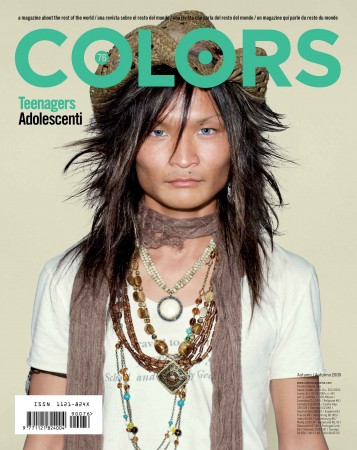

Il n°76 Teenagers ha ottenuto il 1st Prize Stories nella sezione Art and Entertainment del World Press Photo 2010 con il reportage Rainbowland di Kitra Cahana ed è anche Merit Winner alla 89^ edizione dell’Art Directors Club. Il n°79 Collector si è aggiudicato il Silver Prize nella categoria Editorial Design della 90^ edizione dell’Art Directors Club.

Nel 2019 COLORS è rispuntato sotto forma di esperimento editoriale su Instagram: @colorsmagazine